The wellbeing of the turkey and the margin of safety

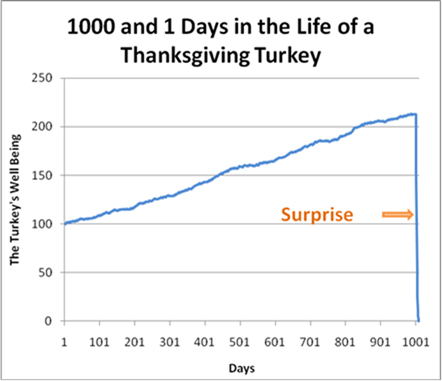

We are right smack in the middle of the holiday season. Thanksgiving has come and gone and the December holidays are imminent. This is not a good time to be a turkey – see the graphic below:

It takes about 2.75 years for a turkey to reach their “best” potential. During this time the turkey has a pretty decent life with its general well being increasing over 100%. Then, day 1,001 comes and the turkey’s whole day is ruined (and then some).

Do not be an investment market turkey when markets go down or when volatility increases significantly. Do not live your investment life with blinders on thinking that “day 1,001” will never come. Day 1,001 (or a less harsh form of it) does eventually come in all investment markets. Markets do go down periodically. We all know this and resign ourselves not to be investment turkeys but it is hard to practice consistently.

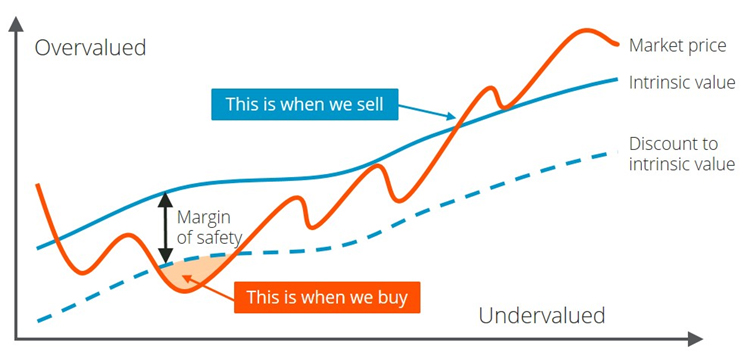

Fortunately, there is an investment practice called the “Margin of Safety” that can prevent you from being an investment turkey. Pioneered by Benjamin Graham, the “Margin of Safety” is simply the practice purchasing securities at prices sufficiently below their underlying value to allow for human error, bad luck, or extreme volatility in a complex, unpredictable and rapidly changing investment market. Margin of safety is all about price where you buy BELOW the underlying (or, intrinsic) value of the security. The margin between the price you purchase the security at and the expected intrinsic value is the buffer that allows you to make money by not losing money. See the below graphic.

Estimating a security’s expected intrinsic value is the hard part. It is literally impossible for anyone (including the most astute and experienced investors in the market) to be able to determine the exact intrinsic value of a business. This is because the intrinsic value is generally based on assumptions and assumptions are often incorrect. Nevertheless, estimating a margin of safety will give you a certain amount of protection and allow room for error in light of the many fluctuations that could occur under the current market conditions.

A good example application of the margin of safety concept applies to bridge building. Engineers build bridges to hold three-times the estimated capacity of the expected traffic weight load. If the expected traffic weight load is ten-tons then engineers build a thirty-ton bridge and the difference of twenty-tons is the margin of safety.

Don’t be an investment turkey blindly investing hoping that day 1,001 never comes. Purchase securities with a margin of safety and days 1,002 onward will be tolerable even during market downturns.

Sean Miller is an independent investment advisor located in Charlottesville. He is not an investment turkey and can be contacted at 434-825-0000 or sean@millerasset.com