RISK – Two Views

In investment management there are, essentially, two views on risk:

- The correct way: Risk is the potential for loss of capital. That’s it. Risk is defined by either making gains or incurring losses on your investment assets. Unequivocally, this is how most investment managers (and I do in my practice) should define risk in the management of your assets.

- The (unfortunate) Industry-Standard Way: The most common view of risk frequently used by salesman-like, asset aggregators at any of the large banks as well as brokerage firms with initials ML and MS, is to view risk as volatility. Volatility is the daily price movement (up and down) of securities and thus appreciation or depreciation of your aggregate portfolio. The higher the standard deviation (volatility), the higher the risk, according to this industry-standard approach. Simply put, the standard deviation of a market or stock is the percentage amount it is expected to move on average over the course of a given time period (i.e. a day, or year). If a stock has a daily standard deviation of 1%, then according to a normal distribution, 68% of the time it is expected to move within +1% or -1% a day, and 95% of the time it is expected to move within +2% or -2% a day. This statistical method fails to take into account many other risks and has no permanent correlation to true risk (i.e. loss of capital = the correct way). This fact alone should cause one to be concerned by anyone who takes this approach.

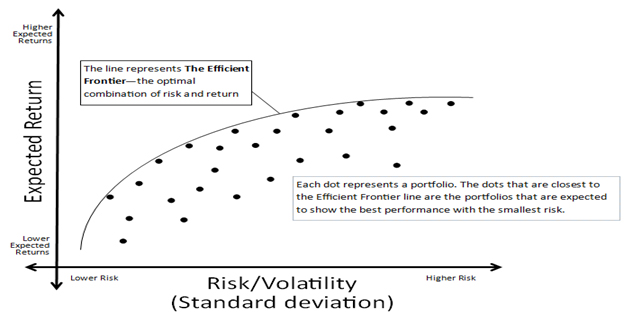

Below is the standard graphic (the “efficient frontier”) used to illustrate an average return corresponding to a specific standard deviation. You may be very familiar with this graphic if it was presented to you by your investment-salesman for you to determine your asset allocation (usually the standard 60% Equities/ 40% Fixed Income). You were expected to determine your asset allocation from this graph much like you were selecting your dinner from a restaurant menu. The problem is – it is not that simple. How is one to divine from this graphic and decide their optimal level of risk and thus their chosen average return? No one can ever truly understand all risks in the financial system, regardless of academic pedigree or professional experience. Your salesman who presents this graphic to you is displacing the risk (and thus the liability) on to you! If you choose 60/40, then how is your investment “professional” responsible if it underperforms a portfolio of 80% Equities/ 20% Fixed Income? It is a game that large banks and brokerages foist on to you.

Fortunately, there is a better way. Prudent investment managers (such as myself) are adamant that true risk is the loss of capital. If we lose you money, then we should be responsible to make up that loss. There should be no discussion of relative returns versus an index. The bank/ broker salesman line on relative performance usually goes “Well, we lost LESS than the S&P 500 – aren’t we fantastic?” No – not fantastic. You still lost money. The better, more-prudent discussion is to say “We lost you money. We will recoup those losses before we take fees again.” Ask your manager for this arrangement. If they say “No”, then you might want to reconsider who you work with.

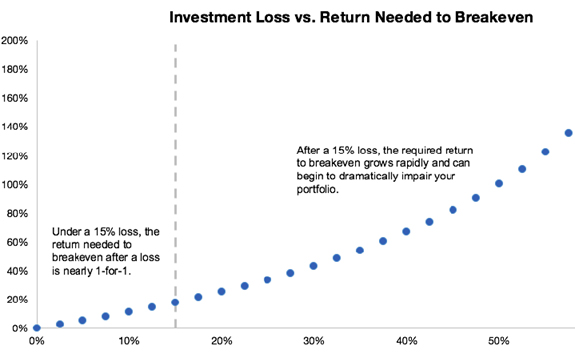

Investors naturally fear losses. Loss aversion means that we feel losses between two and two-and-a-half times as strongly as gains. This all makes sense as recouping losses is difficult. The graphic below illustrates the returns needed to recoup losses. For losses below 15%, we can see that subsequent return required to breakeven is nearly 1-to-1. After a 15% loss, however, the results quickly become skewed. A 35% loss requires a subsequent 53.8% gain. A 50% loss requires a 100% gain. For more extreme losses, these values start to get absurd. A 90% loss requires a 900% recovery while a 99% loss requires a 9900% recovery.

The asymmetric nature of this data proves mathematically a very intuitive idea. Namely, protecting against losses is the name of the game when it comes to risk.

So, find an investment manager that does not foist the asset-allocation on you and that takes 100% of the responsibility for losses. These folks are the true fiduciaries in the investment business and will serve you well.

Sean Miller

Miller Asset Solutions LLC, www.millerasset.com 434-825-0000