Great investment ideas start from disasters

It is true. You just may not know it at the time – but disasters are very fertile grounds for finding undervalued securities for investment. Disasters are the catalytic event that unlock the difference between the price of a security and that security’s value. The price of a security is debated (traded) every business day in the markets – resulting in the price changing frequently (known as volatility). Thus, the day-to-day stock price movements do not reflect changes in the fundamental, intrinsic value of the underlying business as much as they instead reflect a host of other factors, perhaps most notably investor/trader psychology. As long as the company is viable and produces a good product or service, then the value will ultimately be realized over time.

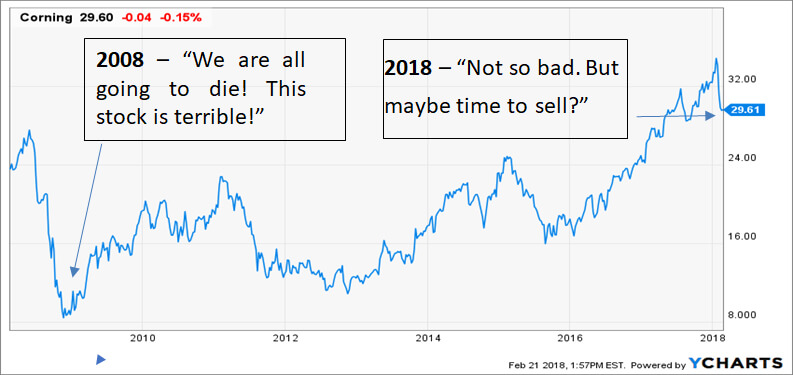

Take Corning, Inc (symbol: GLW) illustrated below. In 2008, when the financial markets were in turmoil and the fundamentals of Corning were in question the stock traded as low as $8.00 per share. Now, in 2018, Corning is trading close to $30.00 per share – a significant improvement of close to 270%. THE POINT? In the time immediately after 2008 and before 2018, investors questioned whether owning Corning (or any stock in 2008) was worth it. It clearly was worth it if you (a) know the company offers great long-term value and that the price (in 2008) was clearly an aberration and (b) have the psychological fortitude and moxie to stay with it and hang tough.